The Real Dollar Value (RDV) is created by comparing the growth and inflation rates of two countries at parity.

The Market Dollar Value (MDV) may emerge at different levels than the RDV in some periods and especially in countries where the exchange rate is controlled.

Countries with export-oriented economic policies - especially China and other East Asian countries - deliberately devalue their national currencies, resulting in the RDV falling far below the MDV. Such policies can be sustained for many years and contribute to the economic development of countries and the well-being of their people.

China is the best at implementing this policy. Look at the Chinese Real Dollar Value Chart (RDV) created since the beginning of 1985. The MDV of the Chinese Yuan shown in blue is 7.19, while the RDV of the Chinese Yuan shown in red is 2.84. There is a positive difference of 153%. This is more than 2.5 times.

This chart is the most important reason for the trade war between China and the US, which will intensify in the coming years. China will not give up, the US will press and we will see how the process will develop.

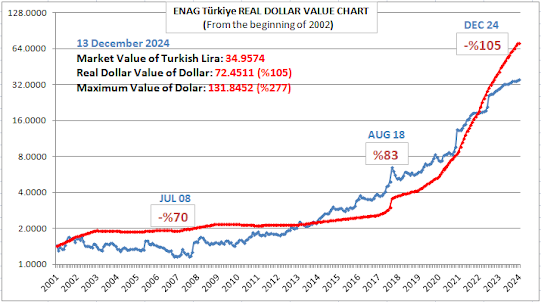

A few countries, such as Türkiye and Iran, deliberately press and debase their national currencies to combat inflation and try to keep the Real Dollar Value above the Market Value.

Look at Iran’s Real Dollar Value Chart. The RDV in red colour was below the MDV at China's chart. But in this chart the RDV curve is considerably higher than the MDV. What will happen as a result? They will be forced to devalue, just like they did in 2001 and 2013. In fact, Iranian currency has been traded at 500,000 to 600,000 against the dollar on the black market for a long time.

A similar graph is in question for Turkey, although not as severe. We will examine this situation in detail in the Real Dollar Value broadcast in a few days.

No comments:

Post a Comment