In this chart the trend lines are extended to January 2028. A sixth-degree polynomial is used here. If such a realization occurs, this chart shows us that gold could rise to $5,750 and silver to $75 by the end of 2027-early 2028. Of course, the trend could follow a different path, and the process could present a very different picture. Here, we are only making a mathematical inference based on the data.

Mathematics is infallible, but the process may necessitate different mathematics.

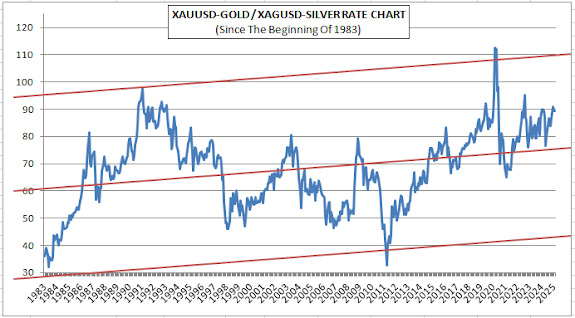

Indeed, the chart below shows us such a possibility. You must have noticed the upward trend in the Gold/Silver Ratio Chart created from the beginning of 1983 to the present. While the midline of the Gold/Silver Ratio was 61 at the beginning of 1983, today this midline seems to have risen to 75. In other words, in terms of averages, gold is approximately 23% more valuable than silver compared to 42 years ago.

I mentioned it in one of my previous publications. Now it is time to repeat it: The date when the Gold/Silver Ratio was first determined coincides with the Roman Empire. At that time, the gold/silver ratio was 12:1. In the early twentieth century, it rose to 40:1. Later, we see that at first 60:1, and today 75:1 are valid. I expect this ratio to reach its peak of 100:1 in the coming decades. Of course, this is not something that can happen overnight, it is a prediction that can happen around 2075.

No comments:

Post a Comment