Pay attention to the table below. The total amount of gold ever mined on earth till today is 212,582 tons. 17% of this amount is in Central Banks, 45% is in jewelry, and 22% is used for investment purposes.

Proven reserves are approximately 59,000 tons. That is 27% of the total amount of gold ever mined. Annual gold production is 3,680 tons. As long as these production rates are maintained and new reserves are not found, the amount of unmined gold in the world will fall to zero in 16 years. This fact is the most important indicator of why gold will rise in the medium term.

The second reason is the increase in gold production costs. Gold production costs have been increasing steadily since the first quarter of 2016. And today they have reached $1,450. The market price of gold is currently 1.82 times higher than its cost.

While inflation is a factor in the increase of costs, another important factor is that gold is now being extracted from more costly and less accessible mines. In other words, gold extraction costs may increase geometrically in the coming period. This realization will naturally push the price of gold much higher.

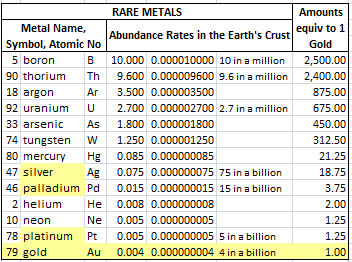

In our current table, we see the ratios of rare minerals in the earth's crust. The abundance and economic importance of boron and thorium minerals in Turkey are debated. However, the total amount of these two minerals is much higher than other rare minerals. Boron and thorium are found in the earth's crust at approximately 10 parts per million. However, the gold ratio in the earth's crust is only 4 parts per billion. In other words, boron is a mineral that is 2500 times more abundant than gold.

Uranium is 675 times more abundant than gold, silver 18.75 times more abundant, palladium 3.75 times more abundant, and platinum 1.25 times more abundant. Gold is a very rare mineral, and there is only 16 years of unmined gold left. If gold doesn't gain value, which one will?

No comments:

Post a Comment