While almost all investment instruments gained value from the beginning of the pandemic until September 2023, the price of gold remained stuck between $1700-2000.

From this date onwards, its rise begined and has provided a return of 38.26% in dollar terms to date. In September 2024, the ounce price of gold reached its peak at $2805.40. Today, it is 5.91% below this value. We will understand what will happen in the future from our upcoming graphs.

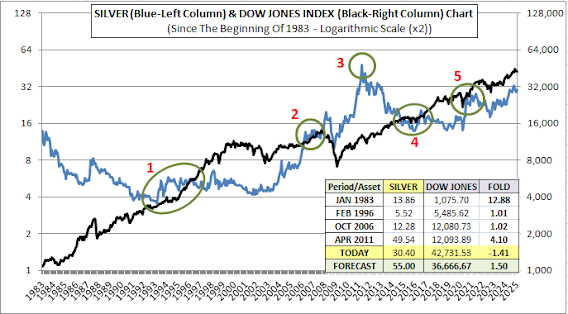

What did gold do while the Dow Jones Index increased sixfold from 8,000 to 48,000 since the beginning of 1972? Now let's look at this chart. This chart, which is important in terms of predicting the future of both, uses a logarithmic scale.

The black color represents one ounce of gold, and the blue color represents the Dow Jones Index. Notice the green circles.

The first circle is in September 1980. Gold outperformed the Dow Jones Index by 6.80 times during this period.

From this date to December 1994, the price of gold fell and the Dow Jones Index rose. On this date, shown as the second circle, both returns were equal.

The third circle is in January 2000. While gold's decline accelerated, the value of the Dow Jones Index increased, and the Dow Jones Index reached a price 4.15 times higher than the return of gold.

There is a great lesson that gold investors should learn from this. The rise is never permanent. When good returns are achieved at certain times, selling and moving to other investments is very important. Indeed, we see that gold investors lost money in the twenty-year period from 1980 to 2000. It's a long period and also the amount of loss is quite high. The importance of creating investment basket is obvious. You can change the portions of the basket you create, but never stick to a single investment instrument.

In our fourth green circle in December 2008, gold and Dow Jones Index returns are equal once again. After that Dow Jones Index return exceeds gold. Today, the difference between them is 1.62 times. This means that Dow Jones Index provided 1.62 times better return than gold.

I am making my first prediction about the future price of gold here. I think that in the near future, the return of black gold will be at least 1.5 times higher than the return of blue Dow Jones Index. In this context, Dow Jones may fall to 36,000 and the price of gold may reach 5,500 dollars.

My second prediction is seen in our current chart. This chart is a very special chart. Here, the return of gold is proportional to the return of the Dow Jones Index. It gives us a much better picture than our previous chart. The peak of gold, marked with the number 1, was in September 1980 and the bottom of gold, marked with the number 3, was in January 2000.

My first prediction for gold was $5,500 in the previous chart. My second prediction for a more distant future is that, the return of gold could exceed the return of the Dow Jones Index by two times. If this happens, the price of gold could reach $9,000 per ounce while the Dow Jones Index stays at $45,000.

How do I claim this? We will see this in our next charts.

In this context, our first chart is our logarithmic US inflation adjusted gold chart from the beginning of 1972. The correction has been applied backwards. Therefore, gold's 1980 peak rises to 2,644 and its 2011 peak rises to 2,695. The bottom point in 2000 is $465. Gold price tries to exceed $2,700 per ounce for the last 15 years.

This upward effort of gold can be seen much more clearly in the new large-scale chart created since 2006. The lows are now higher than before and the highs are now much more tightly confined. The previous low was 1396 and the last low was 1718. Once $2700 is definitely broken, it should not be a surprise to see $3,000-$3,300 levels in a short term.