The first table below shows the Real Dollar Value Ranking of Countries. China is in first place, Iran is in last place. The positive rates indicate how worthless the country's national currencies are against the dollar, while negative rates indicate how valuable, or expensive, the country's national currencies are against the dollar.

China's value is 156% as can be seen in the chart.

The blue colored Dollar's Market Value In Chinese Yuan is 156% above the red colored Dollar's Real Value In Chinese Yuan. If China were to free the value of its currency to be determined by the market, it would be expected that the Chinese Yuan would gain value due to its superior economic performance over the last forty years; in other words, that the blue colored market value would approach the red colored real value curve. However, China does not do this at the expense of angering the US and fueling a trade war, and continues to keep the value of its national currency low in order to strengthen its international competitive advantage.

On the other hand, Iran, which is in last place on the list, prefers to keep its currency overvalued by -391%. This could be a policy that enables oil sales well below market price by breaking the embargo. However, as you can see from the graph, they were forced to devalue twice in the past, and they will be forced to devalue up to 10 times more in the near future.

The Iranian monetary regime is very complicated. The official currency is the Riyal, but people use the Toman unit, which they express by removing one zero from it when doing their daily shopping.

The Central Bank of Iran announced that it will remove five zeros from the Riyal, but it has not yet come into effect. When they do this, they will probably carry out a devaluation in advance. This may be the reason of delay.

In addition, there are different exchange rates in Iran, such as the official exchange rate, free market exchange rate, NIMA and SANA systems. It is stated that as of March 2025, the official exchange rate for 1 dollar is 42,000 rials; the NIMA exchange rate is 670,000; the SANA exchange rate is 700,000; and the free market exchange rate has recently reached 980,000.

In other words, the strategy of suppressing the national currency and keeping it forcibly valuable not only creates competitive difficulties, but also triggers an inflation spiral like the one Iran is facing.

Türkiye is in 58th place on the list with a value of -7%. This rate indicates a level very close to the real value, but when we look at the exchange rate practices of other world countries, it presents us with a picture that puts Türkiye at the bottom of the list and shows us how valuable the Turkish Lira is against the dollar - despite the recent increase last week.

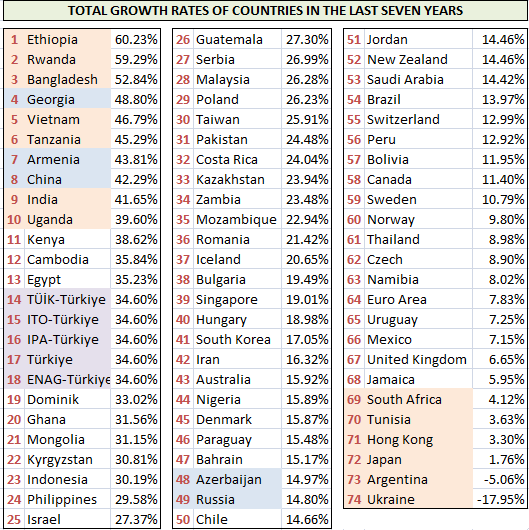

The Real Dollar Value of Countries ranking in the previous table gave the picture from the past to the present. The current table reflects the situation of the last year.

It can be said that the Chinese economy has slowed down in the last few years. Perhaps this is because the annual real dollar value change rate has decreased to 0.06% and China has fallen to 16th place in this field.

Argentina, Türkiye and Nigeria share the last places. This table is a real indicator of the development and decline of world country economies. In order for a country's economy to develop in a way that will provide the most benefit to its citizens, it needs to climb to the top of the table and increase the real value change rate to positive.

When you look at the Türkiye graph, you can see how steeply the red real dollar value curve climbs without ever bending its neck. This is the graph of an unsuccessful economy that contributes the least to the livelihood and savings of its citizens.

Georgia and Armenia are in the first two places of the Real Dollar Value Table for the last year.

Look at the Armenia chart. They have kept the market value of the dollar above the real value since the devaluation in 2014. In the last five-year period, the downward momentum of the real value has accelerated.

Of course, achieving economic success is not something that can be achieved only by increasing the value of the dollar. In addition, it is necessary to determine the most appropriate development strategy and implement it with determination, complete the necessary infrastructure investments, develop political and economic relations, and take appropriate financial and monetary measures.

Georgia’s devaluation practice also coincides with Armenia’s, around the same time, in 2013-2014. They increased the market value of the dollar well above its real value. In fact, they were not very successful in the 6-7 year period leading up to the pandemic. In the last four years, you can see how rapidly the red real value curve has been curving downwards.

We see this success of Georgia and Armenia in the countries’ total growth figures over the last seven years. Georgia has grown by 49% and Armenia by 44% in the last seven years.

The top ten countries include South East Asian countries such as China, India, Vietnam, Bangladesh, as well as Middle East African countries such as Ethiopia, Rwanda, Tanzania, and Uganda. The face of Africa has begun to change rapidly in recent years.

Look at the chart of Rwanda, which is in second place. The red colored real value curve has not yet bowed its head. This shows that no great success has yet been achieved in increasing the collective welfare of its people. However, the market value of the dollar is 126% above its real value.

In the chart of Bangladesh, which is in third place, we see that while the market value of the dollar has continued to climb for the last year and a half, the real value curve has finally bowed its head. If the real value curve maintains its position, the upward trend in the market value will also stop and much more positive developments can be achieved in the country's economy for the benefit of the people.

Bangladesh is one of the poorest but fastest developing countries in the world.

Look at the chart of Vietnam. The market value of the dollar has continued to rise for the last fifteen years, but the real value of the dollar has now bowed its head and the difference between them is growing. This difference is currently at 97.5%.

You see that devaluing the national currency is not a coincidence in achieving economic success and increasing the welfare of its citizens, right?

Look at Uganda. There is a similar picture here. The market value of the dollar continues to increase, albeit with very small values, but the real value of the dollar has been in decline for the last ten years. In other words, Uganda's economy has been in a better position than the economic performance of the US for the last ten years.

In terms of the total growth rates of countries in the last seven years, Turkey is in 14th place but this isn't much likely believable.

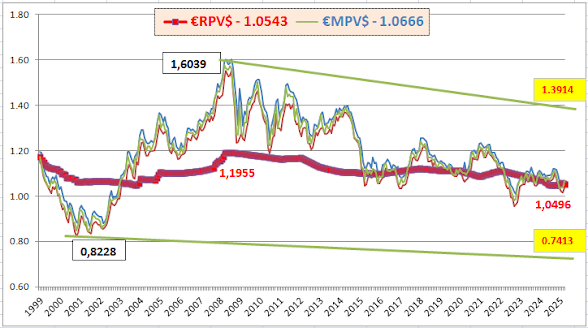

In terms of the last one-year growth rate, Turkey is in 47th place with a ratio of 2.45%. Argentina, Jamaica, and New Zealand have shrunk. The growth rates of Europe and England are below 1%.

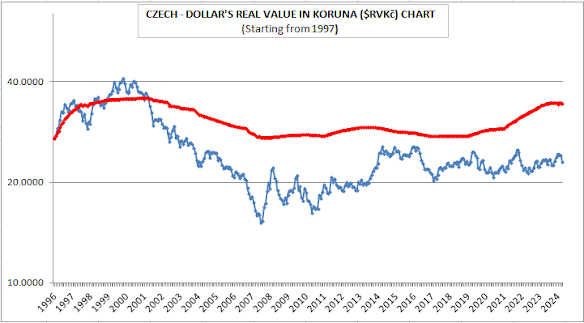

The Czech Republic's growth rate is 1.45%. The growth rate for the last seven years was also low, 8.90% and the country is ranked by 62nd level. We can also understand this situation from the upward slope of the real dollar curve for the last seven years. And recently, the gap between these two curves has reached to -50%.

The Czech Republic's export figures are actually above its import figures, but the ratio of its current deficit to national income has exceeded 5%. With the advantage of being a member of the European Union and of course being a country governed by the rule of law, it finances its current deficit with direct foreign capital inflows.

The growth figures of Saudi Arabia and Bahrain are not very high either, but they have had extremely stable economies for the last forty years.

The first chart above is Saudi Arabia's. The second chart below is Bahrain's.

You can see how the value of their currencies is fixed to the US Dollar. The real dollar values in red color are declining. In other words, they have a more successful economy than the US.

Among the countries that have grown at the fastest pace in the last year, just like in the last seven-year period, are countries such as Rwanda, Ethiopia, Georgia, Vietnam and Uganda.

Cambodia is in the seventh place. This country has also pegged the value of its currency to the US dollar. The real dollar value in red continues its rapid decline, thus the Cambodian economy continues its stable growth and the welfare of its people increases.

India is a country that provides high growth rates. It is even said from time to time that it is on its way to becoming the second China. However, when we look at its chart, we see that this is not the case. India continues to reduce the market value of its currency in order to gain a competitive advantage. However, the real dollar curve in red is also increasing at approximately the same rates. In other words, it is not yet possible to speak of a real and publicly reflected economic success. However, this situation may change in a few years. Signs of this devolopment are also being observed.

The Philippine economy is much more successful. For the last decade, the market and real values of the dollar have been accelerating in opposite directions. This chart is a definitive proof that the increase in the market value of the dollar does not necessarily lead to an increase in inflation.

In our current table, we see the total inflation rates of the countries over the last seven years.

Argentina is in last place with a rate of 6679%. It is followed by Turkey and Iran. According to ENAG inflation data, the total inflation rate for the last seven years is 2624%. On the other hand the average total inflation of Türkiye is 1187%. In other words, life in Turkey has become seven to twenty-seven times more expensive in the last seven years, according to different institudes those reveal inflation datas.

The current table shows the inflation rates for the last year. Turkey and Argentina are again in last place. Countries such as Nigeria and Iran follow. Ukraine, which is at war, has 14% inflation, and Russia has 10% inflation. Georgia's inflation is 2.83% and Armenia's is 2.91%. Israel's is 3.24%.

China's and Indonesia's inflation is negative. In Indonesia, living has become 0.42% cheaper in the last year.

We see the reason of this success in the Real Dollar Value charts. In the last fifteen years the market value of the Indonesian currency has been increasing although it has stayed flat in the previous fifteen years. This development did not increase inflation and only regressed the Real Dollar Curve. In this way, the marketing of Indonesian manufactured goods provides a competitive advantage, and in this case, it strengthens the economy and increases its citizens welfare.

The table below gives the economic performance values of the countries in the last seven years. The lower the number, the more successful it is. China ranked first with 3.75 points. It is followed by South East Asian countries and Middle East African countries. Armenia, Israel, Indonesia, South Korea and Georgia are the other countries in the top fifteen countries. Turkey is in 63rd place with its hormonal growth process and truncated inflation process.

Azerbaijan is in 58th place. After the strong devaluations in 2014, 2015 and 2016, the values of their currencies have been pegged to the US dollar in recent years. However, it seemed that they encounter some difficulties to meet the necessary requirements so the Real Dollar Value continued to rise. Moreover, this momentum has been increasing in the last two years. Perhaps the market value will fall below the real value this year and this will cause Azerbaijani currency to a new devaluation.

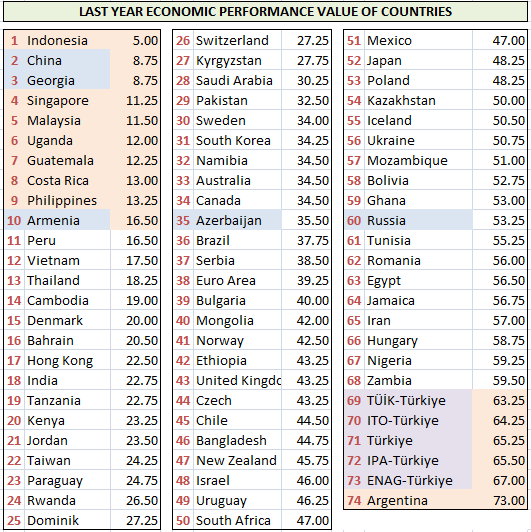

In our current table, we see the economic performance values of the countries in the last year. While China has fallen to second place in this list, Indonesia has risen to first place. Argentina is in the last place and Türkiye is in the second worst place.

In the last table below, we are monitoring the impact of currency devaluations on the economic performances of the countries.

On the left row of countries there is the economic performance rankings and on the right row of countries there is the Real Dollar Value rankings. Except for the colored countries, these two lists are in harmony with each other.

The reasons of the deterioration in the harmony of the colored countries may be as follows:

The yellow colored ones are the majority countries that can be considered to report lower inflations and higher growth rates on a large scale.

Denmark and Switzerland, marked in purple, are countries with strong and highly convertible currencies.

It can be said that Israel and Armenia, marked in green, receive high levels of foreign support in terms of aid and investment.

Bolivia and Guatemala, in light blue, are countries that have pegged the value of their currencies to the US dollar.

Look at the Denmark chart. Since the market value of their currencies started to rise, their real dollar curves have also started to decline. Their economy was not this successful before.

We finish with the Kenya chart. They were not performing very well because their currency had low convertibility and the market value was below its real value. Due to the strong increase in the market value of their currencies in the last five years, their real value dollar curves, marked in red, have finally started to decline.