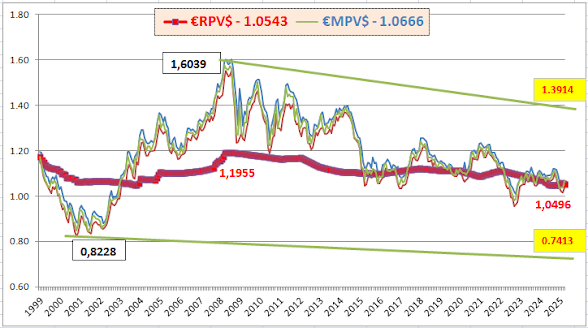

Today, the Market Value of the Euro/Dollar parity(€MV$), is 1.0666, while the Real Value of the Euro/Dollar parity(€RV$) is 1.0543. There is only a 1.17% difference between them.

The current equivalent of the lowest value of -26% seen in May 2001, or the minimum value to which the Euro/Dollar parity can fall, is 0.7413.

The current equivalent of the highest value of 32% seen in June 2008, or the maximum value to which the Euro/Dollar parity can climb, is 1.3914.

Our second chart shows the highest and lowest market values along with monthly closing figures.

The thick red curve shows the change in the Real Euro Value. This curve has been in decline for 17 years since 2008. The process that started from the peak of 1.1955 in June 2008 saw its lowest value of 1.0496 as of October 2024.

The reason for this downward trend in the Real Euro Value is that the European economy is showing a weaker trend compared to the US economy. As a result, the Euro is weakening and European citizens are experiencing purchasing power losses.

Our last chart gives a picture of the range in which the Euro/Dollar parity may move in the near term.

If a similar decline occurs as in September 2022, the EURUSD parity may see a minimum of 0.9138.

If a similar increase occurs as in January 2021, the value of 1.1930 will be a significant resistance.

Today, the real and market values of the EURUSD parity are almost equal to each other. Developments in political and economic processes will determine in which direction this movement will strengthen in the coming days.

Of course, technical examination through charts will also be important. We are exactly at the midline of the green support and resistance curves these days. In case of downward or upward breaks, movements towards the 0.9138 or 1.1930 levels mentioned in the previous chart may accelerate.

No comments:

Post a Comment